It’s obviously hugely important that you start your AAT journey enrolled on a course that’s right for you…

Identifying the appropriate course will to a certain extent, depend on what you think your end point will be e.g. you might want to become a freelance bookkeeper; maybe you want a career change and need an AAT qualification on your CV to help you get a job in finance; or it could be that you want recognition for what you already do or perhaps you want to go ‘the whole way’ and become a Chartered Accountant!

Whatever your long terms goals, if you’re new to accounting, the AAT Foundation level (equivalent of Level 2/GCSE) is generally where you need to start*.

At Foundation level, you will have the choice of following the Bookkeeping route or the Accounting route.

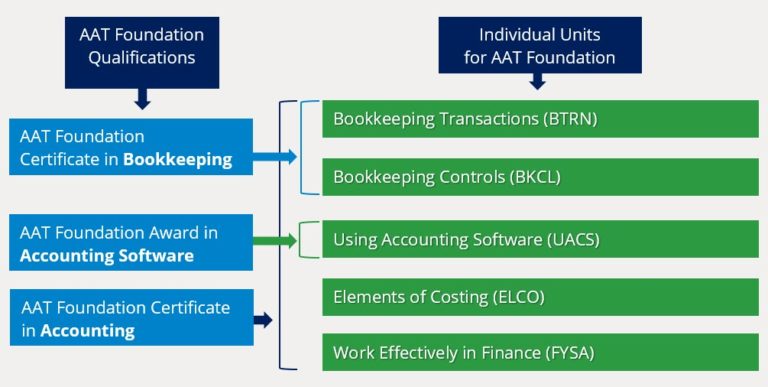

Before we get onto thinking about which route might be best for you, here’s a simple graphic to show you which subjects are included within each of the AAT Foundation qualifications:

Regardless of which qualification you decide to undertake, the two Bookkeeping units are identical in terms of course content (the exams are the same too).

Bookkeeping Route:

As we can see from the graphic above, the AAT Foundation Certificate in Bookkeeping consists of two units (or modules):

- Bookkeeping Transactions (BTRN) – 1 invigilated online exam

- Bookkeeping Controls (BKCL) – 1 invigilated online exam

Upon successful completion, you will receive a certificate directly from the AAT.

You might want to choose this route:

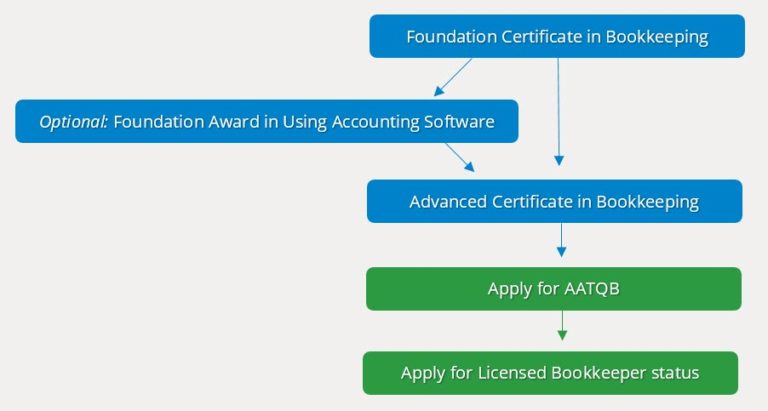

- If you want to become a bookkeeper who prepares full sets of accounts for people (on a self employed basis). You would need to complete both the Foundation Bookkeeping and Advanced Bookkeeping qualifications; after which you would be able to apply for Qualified Bookkeeper and Licensed Bookkeeper status – this will enable you to put AATQB after your name and be part of the AATs Bookkeeping membership body.

- If you want to acquire a qualification quickly, in order to have something to put on your CV when applying for finance jobs – out of all the Foundation units, the Bookkeeping subjects are the ones most sought after by employers. You can always ‘top up’ to the full accounting qualification afterwards if you want to. A downside is that you can achieve grades of ‘Pass’, ‘Merit’ or ‘Distinction with the Accounting qualifications but currently you can only achieve a ‘Pass’ for the Bookkeeping qualifications.

- If you want to spread your costs or complete your qualifications at a slower pace e.g. the Bookkeeping qualification is a ‘short course’, therefore it is cheaper to purchase as there are fewer subjects to study; the AAT registration fee is lower and there are fewer exams to sit (along with their associated costs).

- If you simply want to try a short qualification to start with to be sure in your own mind that ‘accounting is definitely for you’! As previously mentioned, you can top up to the full qualification later on if you want to.

- If you are already working in a finance role but there are a few gaps in your knowledge meaning it would be difficult to enrol directly onto the AAT Advanced Level (where it is assumed you already have a good grounding in double entry bookkeeping).

Once you have completed the Foundation Bookkeeping qualification (and prior to moving up to Advanced Level), you might also want to consider undertaking the computerised accounting unit (using Sage 50 Professional) as this is another qualification highly sought after by employers (it helps massively to have completed the two bookkeeping units prior to starting this one though). It is a standalone qualification in its own right, as well as being a unit that is included in the Foundation Accounting qualification.

This course consists of:

- Foundation Award in Using Accounting Software (UACS) – 1 invigilated online exam (you will use Sage software in the exam)

Upon successful completion, you will receive a certificate directly from the AAT.

At this point, you will still have the option to switch across to the full AAT Accounting qualification if wished i.e. you could complete the remaining subjects at Advanced Level and then progress onto the Professional Level.

Accounting Route:

Again, referring back to our initial graphic, the AAT Foundation Certificate in Accounting consists of 5 units (or modules):

- Bookkeeping Transactions (BTRN) – 1 invigilated online exam

- Bookkeeping Controls (BKCL) – 1 invigilated online exam

- Elements of Costing (ELCO) – 1 invigilated online exam

- Using Accounting Software (UACS) – 1 invigilated online exam

- Work Effectively in Finance (WEFN) – no separate exam

- Synoptic exam – 1 invigilated online exam taken towards the end of your course. This exam includes questions on WEFN as well as questions drawn from BTRN, BKCL and ELCO.

You might want to choose this route:

- If you intend to complete all AAT qualification levels, finishing off with the AAT Professional Level (Level 4). After you have achieved this, you can apply to become a full member of the AAT so that you can put MAAT after your name. At this point, you can call yourself a ‘qualified accounting technician’.

- If you want to progress beyond AAT, achieving all three AAT levels will provide you with a direct stepping stone to further qualifications such as ACA, ACCA, CIMA (to name but a few), in other words, you can start studying towards becoming a Chartered Accountant if this is your desired end point.

- If you want a bit more flexibility regarding your career prospects and earning capability – the higher you go, the more you are likely to earn!

Progression Route

* We mentioned at the beginning that AAT Foundation Level is generally the most appropriate starting point and typically has been the case for many years. However, the AAT have recently introduced Level 1 qualifications (equivalent of GCSE grades D-G). namely:

- Access Award in Bookkeeping

- Access award in Accounting

In our view, whilst there are no specific entry requirements to start your Bookkeeping or Accounting career, we do feel that a natural entry point would be a minimum of GCSE Maths and English grades of A-C. Additionally, as already mentioned, Level 1 AAT qualifications are a recent introduction i.e. Foundation/Level 2 as a starting point has always been good enough in the past, so you could save yourself time and money by skipping Level 1!

However, we do accept that there may be people (including you), who have been out of education for many years and therefore wish to start ‘slowly but surely’.

If you are in any doubt about whether to start at Level 1 or Level 2, then do work through the online skillcheck here. This will be really helpful in identifying the best starting point for you.

To conclude, if you would like to know more about the specific Foundation qualifications we’ve focused on, please click on the following links:

- AAT Foundation Certificate in Bookkeeping

- AAT Foundation Award in Computerised Accounting

- AAT Foundation Certificate in Accounting

Alternatively, do please feel free to give us a call to chat everything through in more detail on 01392 311925

P.S. you won’t feel pressured to buy anything – promise!