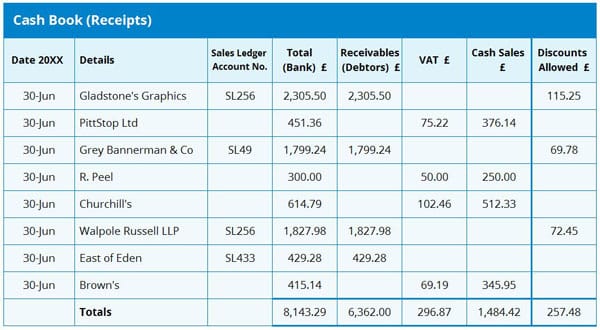

Here’s how to post the Cash Receipts Book:

PLEASE NOTE: If you are interested in learning how to post and balance off the AATs 3-COLUMN CASH BOOK (a key task in the current AQ2016 syllabus exams), please click HERE.

‘Posting the Cash Receipts Book’ to the General and Subsidiary Ledgers (Sales and Purchases Ledgers), is something that can take a little while to get to grips with.

Posting the Sales & Purchases Day Books is reasonably plain sailing, so long as you remember that we are only dealing with sales invoices we’ve sent to credit customers and purchase invoices that we’ve received from credit suppliers i.e. cash sales are not recorded in the Sales Day Book and likewise, cash purchases are not recorded in the Purchases Day Book – these are recorded in the Cash Receipts and Cash Payments Book.

So, how do we post the Cash Book? We will look at the Cash Receipts Book i.e. where we record all money (receipts) paid into our business bank account.

When you first start writing up the cash receipts book, the first thing to do is identify which receipts relate to credit customers (i.e. buy now, pay later customers) and those that relate to cash customers (i.e. buy now, pay now customers). The easiest way to do this is to check and see whether the customer has a sales ledger account (account number column) – if they have, then these customers are credit customers. If there is no sales ledger account number, then the receipt will relate to a cash customer. In our example, we can see that we have 4 credit customers and 4 cash customers.

N.B. In an AAT assessment, Sales Ledger account numbers may not be referred to. However, in ‘real life’ you would probably have a separate column in your cash book to record the Sales Ledger Account numbers (as mentioned above, the Sales Ledger Account numbers will only be applicable to credit customers). If using a computerised accounting system, you will easily be able to identify credit customers from the sales ledger or debtors listing (as set up on your computerised accounting system – cash customers will not have a sales ledger account, nor will they show up in a debtors listing).

Note that the treatment for recording receipts from credit customers differs to that of recording receipts from cash customers.

In our example, we have 3 credit customers and 2 cash customers – we know this because there are 3 entries in the Trade Receivables (SLCA/Debtors) column and 2 other receipts that are not shown in this column. Let’s go into this in a bit more detail:

- Credit Customers: we initially recorded the invoices in the Sales Day Book, so we analysed out the VAT at this point; therefore, we DO NOT analyse out for VAT again when we record the receipts in the cash book (otherwise we would end up paying HMRC twice – definitely not something we would wish to do!) So, we simply record the total receipt amount in the Bank column and the same total amount is recorded in the Receivables (SLCA/Debtors) column.

- Cash Customers: This is the first time that receipts from cash customers will have been entered into the accounting records, so we DO analyse out for VAT. The total receipt amount is recorded in the Bank column, the VAT in the VAT column and the Net amount in the Cash Sales (or Sales) column. Note that you may get a mixture of cash receipts e.g. those that include VAT and those that exclude VAT, so it is important that you use the correct calculation.

For receipts that include VAT: £100 x 20 / 120 = the VAT amount, then simply deduct this from the receipt amount to give you the net amount.

For receipts that exclude VAT: £100 x 20 / 100 or £100 x 0.20 = VAT amount.

So, in terms of the double entry posting from the cash receipts book, this will be:

JOURNAL:

DEBIT: Bank account

CREDIT: VAT account

CREDIT: Sales account

CREDIT: Trade Receivables (Debtors/SLCA)

Cross-casting:

You can save yourself a huge amount of time later on if you remember to cross-cast as it will help you identify (at an early stage), any errors that may have been made. If your overall totals don’t cross-cast then you can cross-cast each line to see where the error is.

In our example, if you add together the totals from the SLCA, VAT, Sales and Sundry Income columns, you should end up with the total as shown in the Bank column. If your two totals don’t agree, you can cross cast each line of the Cash Receipts Book which will help you identify the error.

One more thing, in ‘real life’ you will usually have an ‘opening balance’ in your Cash Book (hopefully on the Receipts side, indicating that you have money in the bank!) When cross casting, remember NOT to include the opening balance when making a comparison with the bank column total i.e. When adding together the SLCA, VAT, Sales and Sundry Income columns, your total should be equal to the Bank total (less the opening balance amount).

Posting to the Sales Ledger:

The Sales Ledger (a collection of individual customer accounts) is not part of the double-entry system, therefore we will only record individual transactions to these accounts. To post the Sales Ledger, we need to go to the Receivables (Debtors/SLCA) column and post all the individual amounts to their respective Sales Ledger accounts. Each receipt will be recorded as a Credit entry in the individual Sales Ledger account – the Sales Ledger is simple a ‘breakdown’ of the Sales Ledger Control Account (SLCA) i.e. the brought down balance on the SLCA represents the total amount owed to us by credit customers whereas the brought down balances on the Sales Ledger accounts (added together), represent the amounts owed to us by individual credit customers. In summary, if an entry is recorded on the Credit side of the SLCA, it will also be recorded on the Credit side of the Sales Ledger accounts. Likewise, a Debit entry on the SLCA will be recorded as a Debit entry in the Sales Ledger.

Well, that’s about it for this little tutorial!

If you found this BLOG valuable and would like to know more about double entry bookkeeping, you might want to consider the AAT Foundation Certificate in Bookkeeping (or the Foundation Certificate in Accounting) – you can read more about this internationally recognised qualification HERE:

Well, we’ve got a fabulous offer for online Bookkeeping courses at the moment – check it out HERE:

We hope that these study tips have helped you! Whilst we are not able to respond to any specific questions you might have about our posts, do please let us know if there are any further topics you would like us to write about. If, however, you are one of our tutor-supported students, please get in touch with your personal tutor who will be more than happy to help you.