Ever thought of training to become a Bookkeeper?

In a previous Blog, we discussed the many variants of ‘Accountant’ and some of the options on how to become one. We referred, (in passing), to Bookkeeping qualifications and promised to write a Blog on how to become a Bookkeeper.

In July 2016, the AAT introduced a professional bookkeeper status, offering a new level of AAT membership. An AAT Bookkeeper holds an AAT associate bookkeeping membership and can use the designatory letters AATQB after their name.

Once you have achieved AATQB, you can apply to become an AAT Licensed Bookkeeper to offer self-employed services in the UK, regulated and supported by the AAT, including:

- Bookkeeping, Financial Accounts and Accounts Preparation for Sole Traders, VAT and Computerised Accounting Systems. You will need to satisfy a work experience requirement for this.

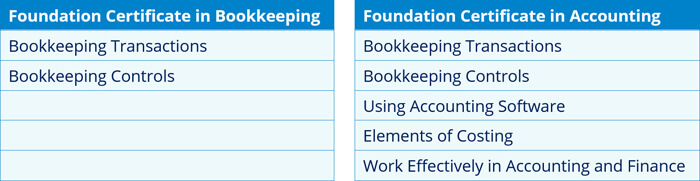

The tables, below, show the difference between the content of the respective AAT Bookkeeping and Accounting qualifications at each level.

Click HERE to request a FREE copy of our course guide that gives a breakdown of what each unit of the Foundation Bookkeeping qualification contains.

Click HERE to request a FREE copy of our course guide that gives a breakdown of what each unit of the Advanced Bookkeeping qualification contains.

For those of you who still remember Venn diagrams from those Maths lessons at school, the Bookkeeping qualification is simply a subset of the Accounting qualification.

If you complete the Bookkeeping qualifications and decide that you can’t bear to live without further studies then you can progress to the Foundation and/or Advanced Accounting qualifications.

But……..

If studying for the AQ2016 full Accounting qualification, you will receive a % mark for each unit and an overall grade for each level of Pass, Merit or Distinction.

If you register and sit for the Bookkeeping qualification, no % mark is given. If you then progress to the full Accounting qualification, it is not possible to transfer a % mark from the papers you passed and a simple 70% mark is given (i.e. the pass mark). This will affect the grade you finally achieve for the full Accounting Qualification. (PS. At the AAT Training Provider Conference, we and other providers lobbied the AAT to change this rule and allocate marks for the Bookkeeping qualifications. They promised to look into it, so watch this space!)

If you know that you simply want to become a Bookkeeper, then you may well want to simply register for these qualifications. It is quite feasible to complete both levels in a year and then apply for AATQB status.

Alternatively, you can register for the full Accounting Qualification, paying the membership subs in addition to the Registration fee. When you pass the relevant bookkeeping units you can then apply to the AAT for the AATQB qualification.

AATQB status requires that you undertake on-going CPD, are committed to the AAT’s Code of Professional Ethics, and are subject to the AAT’s disciplinary processes. The AAT’s Code of Professional Ethics involves following five fundamental principles: Integrity, Objectivity, Professional Competence and Due Care, Confidentiality, and Professional Behaviour.

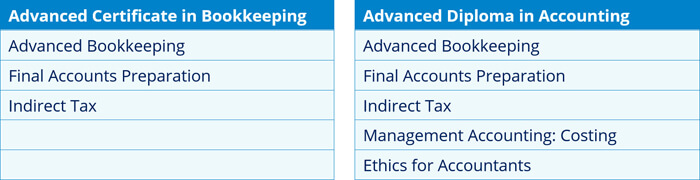

AAT Fees

The respective AAT fees for each option are:

(Fees correct as at 01/01/2017)

In addition to the above are exam fees and exam administration/invigilation fees

Student fees generally increase on the 1st September each year.

Professional membership fees are reviewed on the 1st January each year.

The following link will take you to a recording of an AAT video on “How to build a career with bookkeeping”

https://www.facebook.com/youraat/videos/1658736327489091/

Although clearly biased towards the AAT qualification, we feel obliged to also mention two other bookkeeping qualifications:

1. ICB – Institute of Certified Bookkeepers

Its bookkeeping qualifications comprise:

+ Level II Certificate in Bookkeeping

+ Level III Certificate in Bookkeeping and Accounts

+ Level IV Certificate in Bookkeeping and Accounts

2. IAB – International Association of Bookkeepers

Its bookkeeping qualifications comprise:

+ Level 1 Award in Bookkeeping

+ Level 2 Certificate in Bookkeeping

+ Level 3 Certificate in Bookkeeping and Accounting

We currently only offer the AAT qualifications as we see that as the market leader in the UK and tends to be the qualifications that employers ask for in their job ads. It is also the only of the three that is a UK member of IFAC (international Federation of Accountants), alongside ACCA, CIMA, CIPFA, ICAEW, ICAS and the IFA. https://www.ifac.org/about-ifac/membership/member-organizations-and-country-profiles?letter=U#members

Awards, Certificates and Diplomas

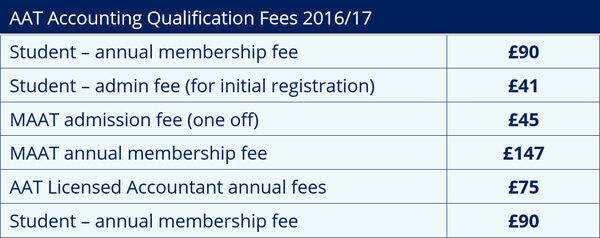

In this Blog we have referred to Awards, Certificates and Diplomas at levels 1, 2, 3 and 4.

What do they each mean? How are they different?

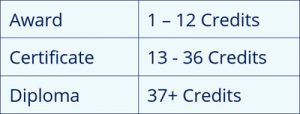

Qualifications on the RQF (Regulated Qualification Framework) are made up of one or a number of units. Each unit is awarded a number of credits. The number of credits given to a unit is determined by the number of notional hours of study – 1 credit equals 10 hours of notional learning. The total number of credits from all the units included in a qualification determine whether the qualification is categorised as an Award, Certificate or Diploma.

It’s all about size

Within each of these 3 categories the difficulty of the qualification is indicated by the level. There are 8 levels, Level 1 – Level 8, where Level 1 is the easiest and Level 8 is the most difficult. Examples of each level are:

- IAB Award in Bookkeeping

- GCSE Grades A-C

- A Levels Grades A-C

- AAT Diploma in Accounting

- Foundation Degree or IFA (Institute of Financial Accountants)

- Honours Degree

- A Masters Degree or ACA, ACCA, CIMA, CIPFA

- A PhD

https://www.gov.uk/what-different-qualification-levels-mean/list-of-qualification-levels

So, the content of a Level 3 Accounting Diploma should be no more difficult than the content of a Level 3 Accounting Certificate but there is a lot more of it! E.G. the three units within the AAT Level 3 Advanced Certificate in Bookkeeping are the same as the equivalent three units in the full AAT Level 3 Advanced Diploma in Accounting. It’s just that there are more units in the AAT Level 3 Diploma in Accounting.

I don’t know about you, but I’m exhausted!

(This Blog was more of a Diploma level than an Award level……..!?!?!)