Is posting to the 3-Column Cash Book driving you barking mad?

Posting and balancing off the AATs 3-column cash book has always been a bit of a tricky one for students.

So, in this blog, we will run through the major points and will also go through a worked example.

As you will know, there are two sides to the cash book:

- The Receipts side (DEBIT) and

- The Payments side (CREDIT)

The receipts side (known as the ‘cash receipts book’) is where we record details of all money coming in to the business i.e. receipts from credit customers as well as cash customers and any other sundry receipt.

The payments side (known as the ‘cash payments book’) is where we record details of all money going out of the business i.e. payments to credit suppliers as well as cash suppliers and any other sundry payment.

In assessments, the AAT treat the Cash Book as being the ‘bank account’ which is why you are not usually provided with a Bank T-account – the Cash Receipts Book and Cash Payments Book (combined) are effectively a giant Bank T-account. At the end of the accounting period, the Cash Book should be balanced off just like any other T-account. We’ll come onto that a little later though!

Cash and Credit Customers Reminder:

- A credit customer is someone who has an account with us i.e. we will invoice them for any goods and/or services we have supplied, and they will pay us at a later date (usually within 30 days).

- A cash customer is someone who does not have an account with us i.e. they will purchase goods and/or services from us and they will pay us immediately (we won’t supply the goods and/or services to them until they have paid us)

Payment Methods:

Any payment method can be used, regardless of whether you are dealing with a cash or credit customer. For example:

- CREDIT CUSTOMER: a credit customer will usually pay their invoice via cheque, BACS or debit/credit card, however, it is perfectly possible that a credit customer will pay their bill in cash (i.e. NOTES and COINS) e.g. if the business has a retail outlet, the customer may pop in to pay their invoice using notes and coins.

- CASH CUSTOMER: a cash customer will pay for their goods and/or services using any payment method e.g. cheque, BACS or debit/credit card, and if they happen to be close by to your premises, they may choose to pay for their goods and/or services using notes and coins.

When a customer pays us in cash (notes and coins), the idea is that we will keep this cash on the premises and use it to pay for any cash payments. If the surplus cash builds up, then you may well decide to bank the excess cash.

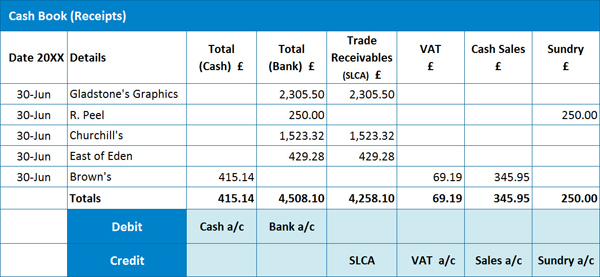

EXAMPLE 1: Cash Receipts Book

Here we have an example of a Cash Receipts Book:

In determining how we record each receipt, it is vital to distinguish whether the receipt relates to a credit customer or a cash customer.

In determining how we record each receipt, it is vital to distinguish whether the receipt relates to a credit customer or a cash customer.

Posting a receipt from a CREDIT CUSTOMER:

It’s important to note that we will have previously recorded the invoice (sent to the customer) in the Sales Day Book, so we will have analysed the invoice for VAT at that point i.e. Debit SLCA for the total (Gross) invoice amount, Credit the Sales account for the Net amount and Credit the VAT account for the VAT amount. It’s crucial then, that we don’t analyse for VAT again when we are recording the receipt in the Cash Receipts Book – if we did, we would end up doubling the sales tax (also known as Output Tax) payable to HMRC, which we definitely wouldn’t want to do!

So, to record a receipt from a credit customer, we need to post the total receipt amount in either the Bank of Cash column (depending on the payment method used) and then record the same amount in the Trade Receivables (SLCA) column. The latter entry is recorded in the SLCA column to indicate a reduction in the amount now owed to us by our credit customers (receivables/debtors).

Posting a receipt from a CASH CUSTOMER:

For cash customers, this will be the first time the receipt (cash sale) has been entered into our accounting records, so we DO need to analyse the receipt for VAT.

So, to record a receipt from a cash customer, we need to post the total receipt amount in either the Bank or Cash column (depending on the payment method used), the Net amount in the Cash Sales account column and the VAT amount in the VAT column. N.B. VAT may not be applicable in some cases. In this instance, the full receipt amount will be entered into another relevant column. You will note that we have an entry in the ‘Sundry account’, the reason being that the sales receipt does not relate to the main trade of the business e.g. it could have related to the repayment of a staff loan.

It’s worth noting that businesses may choose to use a variety of analysis columns for cash sales e.g. you could have a sales column for individual products or separate departments within the business and so on.

We can see from our example that we have 3 receipts from credit customers, 1 receipt from a cash customer and one other sundry receipt.

Cross Casting:

Before preparing your journal for posting to the general ledger, you should perform a ‘cross cast’ i.e. you need to check that your debit entries (when added together), are equal to the sum of your credit entries.

In our example, the overall totals for the SLCA, VAT, Cash Sales and Sundry accounts should be equal to the Cash and Bank account totals.

If your debits and credits don’t agree, then you can ‘cross cast’ each line of your cash book to help you identify where the error is.

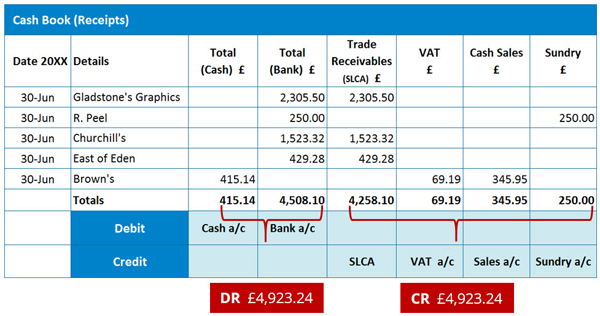

Journal to post the Cash Receipts Book:

Journal to post the Cash Receipts Book:

Debit: Cash account £415.14 (which is increasing our asset of the bank) – these are customers who paid us using notes and coins

Debit: Bank account £4,508.10 (which is increasing our asset of the bank) – these are customers that paid us using a cheque, BACS, debit or credit card or other electronic method

Credit: SLCA £4,258.10 (which is decreasing our asset of receivables i.e. our credit customers no longer owe us as much as they did)

Credit: VAT account £69.19 (which is increasing our liability of what is owed to HMRC)

Credit: Sales account £345.95 (which is increasing our income – this figure relates to receipts from cash customers)

Credit: Sundry account £250.00 (which is also increasing our income – as mentioned, this figure is recorded separately as it does not relate to our main trade)

P.S. REMEMBER to record the individual amounts in the SLCA column to the individual customer accounts in the Sales Ledger!

N.B. Please remember that the AAT effectively treat the cash book as being the Bank T-account.

If you haven’t started an AAT course yet and you are finding this Blog valuable, you might want to consider our AAT Bookkeeping course; more information HERE. We also have a great AATQB Bundle; click HERE to find out more.

Now let’s move onto the Cash Payments Book.

Cash and Credit Suppliers Reminder:

In terms of distinguishing between a Credit supplier and a Cash supplier, the same principles that applied to the Cash Receipts Book apply here too i.e.

- A credit supplier is someone we have an account with i.e. the supplier will invoice us for any goods and/or services supplied to us, and we will pay the supplier at a later date (usually within 30 days).

- A cash supplier is someone we do not have an account with i.e. we will purchase goods and/or services from the supplier and we will pay them immediately (the supplier won’t give us the goods and/or services until we have paid for them)

Payment Methods:

As with the Cash Receipts Book, any payment method can be used, regardless of whether we are dealing with a cash or credit supplier i.e. cheque, BACS, debit/credit card or cash (notes and coins).

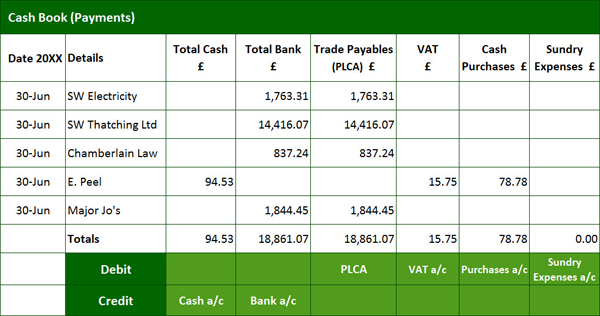

EXAMPLE 2: Cash Payments Book

Here we have an example of a Cash Payments Book:

Posting a payment to a CREDIT SUPPLIER:

Posting a payment to a CREDIT SUPPLIER:

As with the Cash Receipts Book, we will have previously recorded the invoice (sent to us by the supplier) in the Purchases Day Book, so we will have analysed the invoice for VAT at that point i.e. Debit the Purchases account for the Net amount, Debit the VAT account for the VAT amount and Credit the PLCA for the total (Gross) invoice amount. If we analysed the payment for VAT again when recording it in the Cash Payments Book, we would end up doubling the purchase tax (also known as Input Tax) re-claimable from HMRC – a nice idea, but HMRC would not be happy… and neither would we be, if we subsequently ended up getting fined!

So, to record a payment to a credit supplier, we need to post the total payment amount in either the Bank of Cash column (depending on the payment method used) and then record the same amount in the Trade Payables (PLCA) column. The latter entry is recorded in the PLCA column to indicate a reduction in the amount we now owe to our credit suppliers (payables/creditors).

Posting a payment to a CASH SUPPLIER:

For cash suppliers, this will be the first time the payment (cash purchase) has been entered into our accounting records, so we DO need to analyse the receipt for VAT.

So, to record a payment from a cash supplier, we need to post the total payment amount in either the Bank or Cash column (depending on the payment method used), the Net amount in the Cash Purchases account column and the VAT amount in the VAT column. Again, VAT may not be applicable in some cases e.g. if a supplier is not VAT registered. In this instance, the full payment amount would be entered into the Cash Purchases account column or other relevant column. N.B. you are more likely to have more analysis columns in the Cash Payments Book, since there will be a lot of suppliers used that do not relate to your main trade purchases e.g. electricity, telephone, motor vehicle expenses etc.

We can see from our example that we have 4 payments for credit suppliers and 1 payment to a cash supplier.

Cross Casting:

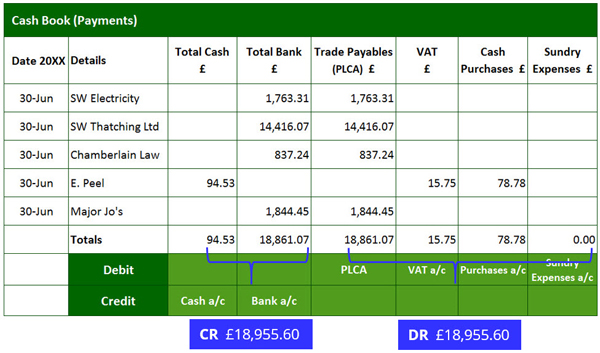

Before preparing your journal for posting to the general ledger, you should perform a ‘cross cast’ i.e. you need to check that your debit entries (when added together), are equal the sum of your credit entries.

In our example, the overall totals for the PLCA, VAT, Purchases and Sundry Expenses accounts should be equal to the Cash and Bank account totals.

If your debits and credits don’t agree, then you can ‘cross cast’ each line of your cash book to help you identify where the error is.

Journal to post the Cash Payments Book:

Journal to post the Cash Payments Book:

Debit: PLCA £18,861.07 (which is decreasing our liability of payables – we don’t owe our credit suppliers us as much as we did)

Debit: VAT £15.75 (which is decreasing our liability of what is owed to HMRC)

Debit: Purchases £78.78 (which is increasing our expenditure – this figure relates to payments made to cash suppliers)

Credit: Cash £94.53 (which is decreasing our asset of the bank)

Credit: Bank £18,861.07 (which is decreasing our asset of the bank)

In this example, we haven’t paid any money in respect of Sundry Expenses, but if we had, this would have been a debit entry too (any other expenditure account would be a debit entry too).

P.S. REMEMBER to record the individual amounts in the PLCA column to the individual customer accounts in the Purchases Ledger!

Now we’ll move onto how to balance off the combined Cash Receipts Book and Cash Payments Book.

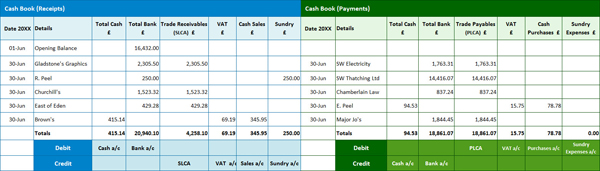

EXAMPLE 3: Combined Cash Book

In past times, the cash book was a physical book with all the receipts manually recorded on the left-hand side (debit side) and the payments manually recorded on the right-hand side (credit side), similar to the format shown below.

For the purposes of this blog though, we shall separate the books to make things a little easier to follow when it comes to calculating the cash and bank balances.

For the purposes of this blog though, we shall separate the books to make things a little easier to follow when it comes to calculating the cash and bank balances.

N.B. Please note that we’ve added an OPENING BALANCE to the previous example.

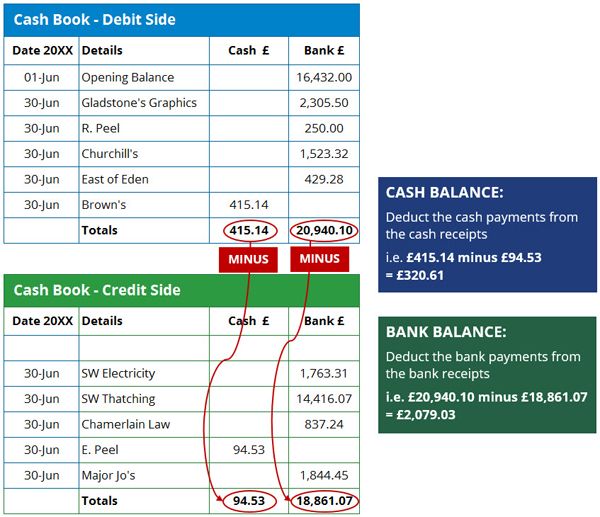

EXAMPLE 3a: Calculating the Balances

How to calculate the Cash Balance:

How to calculate the Cash Balance:

So, to calculate the cash balance, take your total cash figure from the Cash Receipts Book (£415.14 in this example) and deduct the total cash figure from the Cash Payments Book (i.e. £94.53). This will give you a cash balance of £320.61 i.e. you have £320.61 in your cash box, which will be a Debit entry to the cash account in your General Ledger.

REMEMBER, in an AAT assessment, you can NOT end up with a minus figure here – imagine your cash box – you can have zero cash, but not minus cash!

How to calculate the Bank Balance:

So, to calculate the bank balance, just follow the same procedure. Take your total bank figure from the Cash Receipts Book (£20,940.10 in this example) and deduct the total cash figure from the Cash Payments Book (i.e. £18,861.07). This will give you a bank balance of £2,079.03, which will be a Debit entry to the bank account in your General Ledger.

In this example, we started off with £16,432.00 in the business bank account. If, however, your bank total for the Cash Payments Book was higher than the figure recorded in the Cash Receipts Book (i.e. your calculation resulted in a minus figure), this would mean that your bank account is overdrawn i.e. a credit entry in the General Ledger.

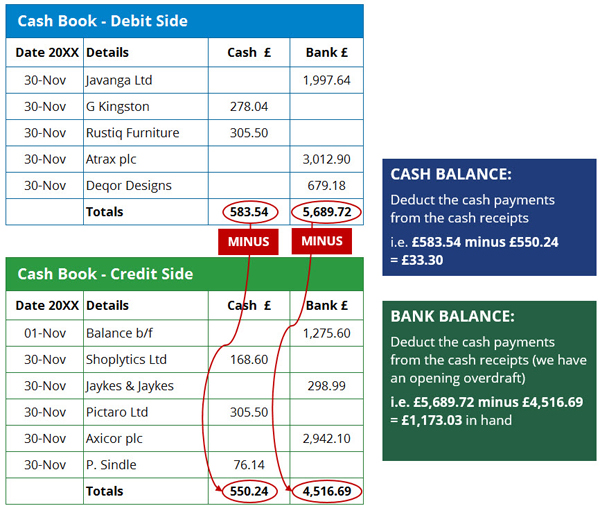

EXAMPLE 4: Calculating the Balances

Here is another example to show you how to calculate the balances:

How to calculate the Cash Balance:

How to calculate the Cash Balance:

So, to calculate the cash balance, take your total cash figure from the Cash Receipts Book (£583.54 in this example) and deduct the total cash figure from the Cash Payments Book (i.e. £550.24). This will give you a cash balance of £33.30 i.e. you have £33.30 in your cash box, which will be a Debit entry to the cash account in your General Ledger.

Again, REMEMBER that you can NOT end up with a minus figure here – you can have zero cash, but not minus cash!

How to calculate the Bank Balance:

So, to calculate the bank balance, just follow the same procedure. Take your total bank figure from the Cash Receipts Book (£5,689.72 in this example) and deduct the total cash figure from the Cash Payments Book (i.e. £4,516.69). This will give you a bank balance of £1,173.03, which will be a Debit entry to the bank account in your General Ledger.

In this example, we started off with an overdraft of -£1,275.60 in the business bank account which would be a credit entry in the General Ledger.

If you haven’t started your AAT journey yet, you get get started for as little as £99! Find out more HERE:

We hope that these study tips have helped you! Whilst we are not able to respond to any specific questions you might have about our posts, do please let us know if there are any further topics you would like us to write about. If, however, you are one of our tutor-supported students, please get in touch with your personal tutor who will be more than happy to help you.