We are often asked which of the five AAT Level 4 optional units to take. You need to select two of them.

Students often ask which of the AAT Level 4 optional units is easiest. All of them are easiest if the topics are those that you like and can do well! But also all of them are the hardest if you do not like the topics and you are not familiar with them based on your work experience.

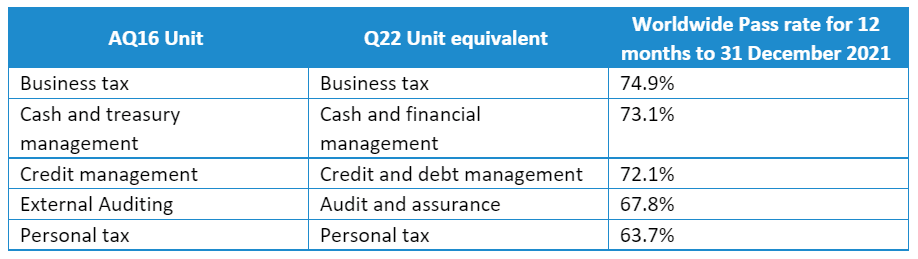

Their relative ease could be judged on their worldwide pass rates. While no one has attempted any of the Q22 optional units yet, they are very similar to the AQ16 units so the AQ16 pass rates may give an indicator.

But these worldwide pass rates are not necessarily an indicator of which you will find easiest. Our Accountancy Learning pass rates do not follow the same pattern and are significantly better.

Another factor to consider is what you do at work. Choosing units that will help you to do your work and that will help you to progress in your career will be a better choice than those that are relatively irrelevant to your work. If you work in practice as an auditor then choosing Audit and assurance would be sensible. If you work as a management accountant then Cash and financial management may be more useful. Talk to your manager and seek advice about which would be most suitable for your job.

But also bear in mind what you may want to do in the future and where your career may lead.

It is worthwhile to think about the links to the mandatory units. If there are any overlaps between the units then your studying may be eased a little. We’ll highlight the overlaps when we examine each of the units in a moment.

Let’s also look at particular issues that the units may have.

Business tax:

11 tasks, 6-15 marks per task, 18-22 marks are for written answers.

Businesses pay a smaller number of different taxes so as well as being tested on calculating the tax due from business, many of the tax rules are tested. Pass rates for business tax are generally higher than the personal tax which may be caused by the smaller range of taxes being tested.

Reference materials are available during the assessment so you don’t need to memorise everything.

There is a little link with any of the units you did for earlier levels or with the core units. However, the adjustments that you will need to make to convert accounting profit to taxable income are similar to the adjustments you will need to make when you prepare a Statement of Cash Flows in the DAIF unit.

There are overlaps between the two tax units so doing them as a pair can be helpful. The two tax units (together with TPFB) allow you to claim an exemption from an equivalent tax paper in the ACA qualification.

This unit will be useful if you work for a firm of accountants. You may work on tax in business, but probably only if you work for a really big company.

Personal tax:

10 tasks, 6-14 marks per task, 8-10 marks are for written answers.

One of the tasks tests ethics which you may have studied at level 3 and overlaps with the DAIF unit. The other tasks test a variety of taxes from income tax to inheritance tax. Some tasks will require you to calculate an amount of tax and some will require a narrative explanation. Anecdotal evidence suggests that it is easier to study personal tax before business tax as it provides a good foundation for the tax techniques. But the sheer variety of taxes, each with its own very different rules, can make this exam difficult.

Reference materials are available during the assessment so you don’t need to memorise everything.

There is a little link with any of the units you did for earlier levels or with the core units. However, the adjustments that you will need to make to convert accounting profit to taxable income are similar to the adjustments you will need to make when you prepare a Statement of Cash Flows in the DAIF unit. As mentioned, ethics was also in level 3 and is also in the DAIF unit.

There are overlaps between the two tax units so doing them as a pair can be helpful. The two tax units (together with TPFB) allow you to claim an exemption from an equivalent tax paper in the ACA qualification.

This unit will be useful if you work for a firm of accountants. You may find this unit interesting just to know how you pay tax and to be able to do your own tax return if ever you need to in the future.

Cash and financial management:

8 tasks, 10-15 marks per task, about 15 marks are for written answers

Cash budgets build on what you did for management accounting in level 3 and there are overlaps with some content in the AMAC unit. But some topics will be new to you and you may find these tricky. You will need to convert a profit figure to a cash figure using the same technique as a Statement of Cash Flow in the DAIF unit.

This unit may be useful if you work in an accounting team in business.

Credit and debt management:

6 tasks, 12-25 marks per task, 25 marks for a written answer in task 3

The large written answer is often found difficult by many candidates because you need to write so much. The question will be broken down, but you still need to write a lot.

There is quite a lot of new content that you won’t have studied before. You will need to calculate ratios and interpret them. This builds on what you did at level 3 and overlaps with the DAIF and AMAC units. The contract law element builds on the law element of level 2 BENV if you did that. The legal element contains a lot of unfamiliar terminology and ideas, and there is a lot to remember.

This unit may be useful if you work in an accounting team in business.

Audit and assurance:

6 tasks, 10-25 marks per task, 40-45 marks for written answers.

This assessment is 2.5 hours, 30 minutes more than all of the other optional units. Having more time to complete the assessment can be considered a good thing. But also, needing more time is a possible indicator of difficulty. The proportion of the marks given to narrative answers may be the reason why you are given more time for this unit.

The syllabus is quite comprehensive and there is a lot to study. Very, very little of it is numerical.

The exam tests the International Standards on Auditing but those who work in audit use their firm’s interpretation of those standards. Employers’ interpretations should not be too different from the standards themselves but there can be differences. You will be used to following your firm’s procedures and using their terminology. These may well be different from those used in the regulations and the exams. If you answer the questions in the exam on the basis of “common sense” and “this is what I do at work” you might well not be presenting the answer in the way that the examiner is looking for. You may not be wrong but your answer won’t be right! You, therefore, need to take extra care to know the terminology and the approach required by the AAT inside out.

Auditors test and rely on controls that you study in the INAC unit. You will audit financial statements which you learn to prepare in the DAIF unit. Ethics is tested which builds on what you did at level 3 and overlaps with the DAIF unit.

This unit may be useful if you work in audit. Passing this unit will provide you an exemption from the Assurance paper for ACA.

Consider carefully doing this unit if you have no experience of audit – you may find it hard to understand some of the practical concepts and techniques, for example, you may need to design audit procedures for a particular section of financial statements.

Ultimately, we cannot give you an answer. Each of your personal circumstances are different but hopefully, our analysis here will help.