We are often asked which of the 2 optional units to take at AAT Level 4…

It’s a difficult question. You need to choose two from five optional units. The five units are quite diverse and allow you to make the AAT Professional qualification more relevant to your career aspirations. Students often ask which of the units are easiest. All of them are easiest if the topics are those that you like and can do well. But also all of them are the hardest if you do not like the topics and you are not familiar with them based on your work experience.

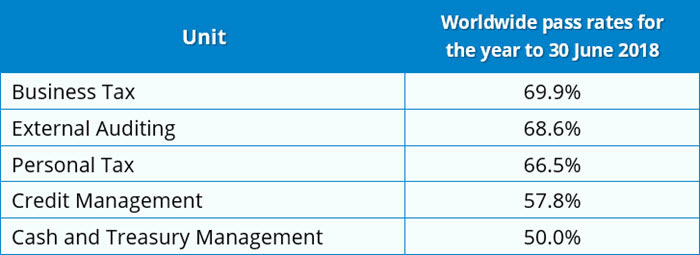

Their relative ease could be judged on their worldwide pass rates.

But these worldwide pass rates are not necessarily an indicator of which you will find easiest. Our Accountancy Learning pass rates do not follow the same pattern and are significantly better.

Another factor to consider is what you do at work. Choosing units that will help you to do your work and that will help you to progress in your career will be a better choice than those that are relatively irrelevant to your work. If you work in practice as an auditor then choosing External audit would be sensible. If you work as a management accountant then credit management may be more useful. Talk to your manager and seek advice about which would be most suitable for your job.

It is worthwhile to think about the links to the mandatory units. If there are any overlaps between the units then your studying may be eased a little. There is a small overlap in the topics between External audit and Financial Statements for Limited Companies so combining these two units could make your studying a little easier. Cash and treasury management involves preparing budgets which overlaps with Management accounting: budgeting; you need to reconcile profit with cash which is also tested in Financial statements for limited companies; and there are statistical techniques and forecasting, which are also topics in Management Accounting: decision and control.

In contrast, the two tax units are quite new with little from previous units to help you and little overlap with the mandatory units. But there is a link between the two tax units so choosing both of them may be beneficial.

Let’s have a look at any particular issues that each unit may have.

External Auditing:

Three of the 23 tasks (yes, 23 tasks!) test ethics which you will have studied at level 3. Because there are so many tasks the marks per task are relatively small and therefore the questions may be considered more manageable. This unit is normally undertaken by students who do audit work.

This is one of the problems. The exam tests the International Standards on Auditing but those who work in audit use their firm’s interpretation of those standards. The employers’ interpretations should not be too different from the standards themselves but there can be differences. You will be used to following your firm’s procedures and using their terminology. These may well be different to those used in the regulations and the exams. If you answer the questions in the exam on the basis of “common sense” and “this is what I do at work” you might well not be presenting the answer in the way that the examiner is looking for. You may not be wrong but your answer won’t be right! You therefore need to take extra care to know the terminology and the approach required by the AAT inside out.

Credit Management:

This exam has seven tasks with a relatively high number of marks per task compared with External Auditing. Some students are less comfortable with bigger questions. The exam includes a large proportion of calculations, using performance indicators that you will have seen already in your previous studies and overlap with FSLC. You will need to calculate the performance indicators and then interpret their meaning and then provide a narrative answer about the business seeking credit. Many students find writing large narrative answers difficult.

Cash and Treasury Management:

This exam consists of 10 tasks with some large questions and a selection of smaller questions. As described above, there are a number of overlaps with the mandatory units which may make your study easier. There are some topics that are likely to be very new to you; topics which you have not seen in your work experience and therefore may be quite hard for you.

Personal Tax:

The exam has 13 tasks with marks ranging from four to 12 marks. One of the tasks tests ethics which overlaps with FSLC and your level 3 studies. The other tasks test a variety of taxes from income tax to inheritance tax. Some tasks will require you to calculate an amount of tax and some will require a narrative explanation. Anecdotal evidence suggests that it is easier to study personal tax before business tax as it provides a good foundation to the tax techniques. But the sheer variety of taxes, each with their own very different rules, can make this exam difficult.

Business Tax:

This exam has 11 tasks. Businesses pay a smaller number of different taxes so as well as being tested on calculating the tax due from a business, many of the tax rules are tested. Pass rates for business tax are generally higher than personal tax which may be caused by the smaller range of taxes being tested.

Many of our students in accounting practice do the two tax papers – unless they are in their audit departments, in which case they may do External Auditing and Business Tax. Many of those working in Industry do Cash & Treasury Management and Credit Management. However, you need to be thinking about, not just what do you do now but what do you want to do in the future.

So what’s the answer? How long is a piece of string?? We cannot really tell you! Each of you has different circumstances, and hopefully the various issues we have discussed here will provide you with the basis for coming to a decision.

P.S. You can always procrastinate and elect to do more than 2!

In fact, some students who are planning to progress to ACA, do the two tax paper and the External Auditing Papers as these provide exemptions from Principles of Taxation and from Assurance.