Boris is still struggling a bit on his AAT accruals and prepayments!

He asked the following question, to try and straighten things out in his head…

“I wonder if I could seek your assistance in ensuring that I have grasped the accrual and prepayment accounts correctly.

My understanding is:

DEBIT EXPENSES

- Expenses are DEBITS

- Prepaid Expenses are DEBITS

- Accrued Expenses are CREDITS

CREDIT INCOME

- Income is a CREDIT

- Prepaid Income is a CREDIT

- Accrued Income is a DEBIT

Is this correct?”

Hi Boris

This looks spot on. Although, you might want to clarify the table above by showing which item is recorded in the Statement of Financial Position (SoFP) and which is recorded in the Statement of Profit or Loss (SPL) e.g.

DEBIT EXPENSES

- Expenses are DEBITS (in the SPL)

- Prepaid Expenses are DEBITS (in the SoFP)

- Accrued Expenses are CREDITS (in the SoFP)

CREDIT INCOME

- Income is a CREDIT (in the SPL)

- Prepaid Income is a CREDIT (in the SoFP)

- Accrued Income is a DEBIT (in the SoFP)

You must remember that for every DEBIT there is a CREDIT. So, you are correct in saying that Prepaid Income is a Credit, because you are thinking about it being a Credit in the SofP.

However, the other half of the entry is a Debit in the SPL i.e. reducing the Income for the year (CR)

JOURNALS:

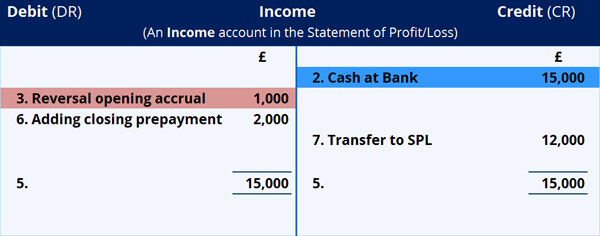

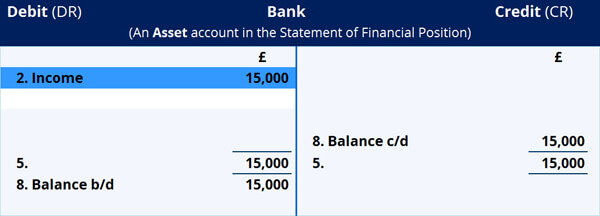

The journal for the initial receipt of income is:

- DEBIT Cash at Bank (SoFP)

- CREDIT Income (SPL)

It is always good to go back to the double entry so you don’t forget which half of the double entry you are looking at. Income is always a Credit in the SPL.

The journal where we are still owed income (this is accrued income) is:

- DEBIT Accrued Income (SoFP – an asset)

- CREDIT Income (SPL)

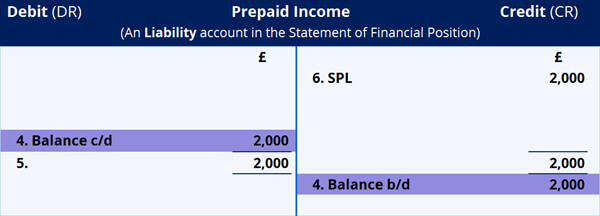

The journal where some of the income we have received relates to next year (this is prepaid income) is:

- DEBIT Income (SPL)

- CREDIT Prepaid Income (SoFP – included in liabilities)

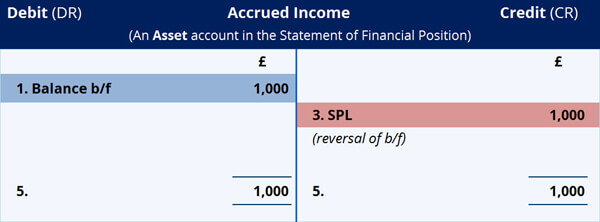

When I draft T-accounts, I often number each transaction/journal so that I can see the order in which they will have been entered into the T accounts.

It is then easy to see:

- The brought forward balance (opening accrual or prepayment)

- The income received during the year

- The carried downbalance (closing accrual or prepayment)

- The totals on both sides

- The transfer to the SPL (the balancing figure) if appropriate

EXAMPLE:

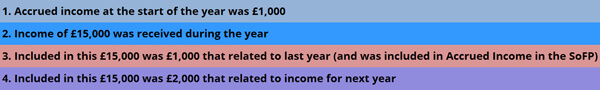

Please refer to the example below, to see the sequence of postings needed to deal with accrued and prepaid income:

To summarise, here are the steps required:

a. Show the opening accrued income brought forward (b/f) of £1,000

b. Post the bank receipt of £15,000

c. Reverse the opening accrual

d. Enter the closing accrual

e. Total off all the accounts

f. Transfer the outstanding balance on the prepaid income to the income account

g. Transfer the outstanding balance on the income account to the statement of profit/loss

h. Carry down the outstanding balance on the cash at bank account

If you found this valuable and would like to know more, you might want to consider our AAT Advanced Bookkeeping course. You can find out more about it HERE

We hope that these study tips have helped you! Whilst we are not able to respond to any specific questions you might have about our posts, do please let us know if there are any further topics you would like us to write about. If, however, you are one of our tutor supported students, please get in touch with your personal tutor who will be more than happy to help you.