When to study AAT Indirect Tax – before, after or in the middle of the other Level 3 units?

In the past we have scheduled the Indirect Tax (IDRX) unit after the first two bookkeeping units, as that seemed the logical place to put it.

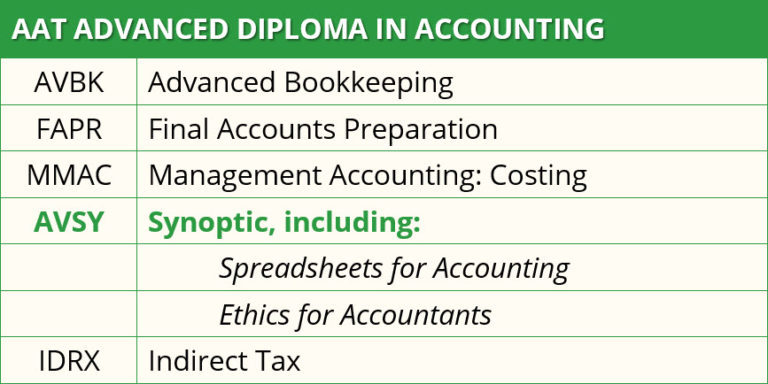

However, as from 2018, the Indirect Tax unit is no longer examined as part of the Synoptic exam. This has made us reconsider whether or not we should move it from its current position in the standard learning plan.

When preparing for the synoptic, you will need to revise the separate subject topics that are covered in the synoptic (i.e. AVBK, FAPR and MAMC, as well as, of course, Ethics and Spreadsheets). It is therefore helpful if you have just studied them. In this way, you will avoid a subject that is not examined in the synoptic from being sandwiched between those subjects that are examined in the synoptic.

At AAT Professional (Level 4), we recommend that the optional units are taken either at the very start of your programme or after the synoptic. At Foundation (Level 2), we generally now programme Using Accounting Software (UACS) after the synoptic. We don’t suggest completing UACS at the start, as you really need to study the two bookkeeping units first.

However, what to do at AAT Advanced (Level 3)? What are the options?

1.IDRX at the end:

Unlike UACS and the Level 4 papers, there is no 6 week wait for the results to come out. Planning IDRX after the synoptic means that you can study and sit it whilst waiting for the results of your synoptic – reducing, or avoiding, the delay in starting Level 4.

2.IDRX at the beginning:

IDRX is not dependent on the knowledge contained within the two level 3 bookkeeping units and so you can get it out of the way at the start. A further advantage is that it is a relatively small unit, so it can be a confidence builder.

3.IDRX after the two bookkeeping units:

a. This seems a logical place to study IDRX if you are working as a bookkeeper or are involved with accounts preparation in a firm of accountants. It is probably more directly relevant to your workplace than the remaining units. Your AAT studies are not just there to give you a qualification but to give you the skills and knowledge that you can apply at work and in progressing your career. We shouldn’t let the tail wag the dog!

b. If you are undertaking the Advanced Certificate in Bookkeeping, you will only have the three units to complete, so IDRX will logically be taken after the two bookkeeping units

c. Even if you are completing the full Level 3 Diploma in Accounting, if you are job hunting, you may wish to complete the subjects in this order so you can obtain your Advanced Certificate in Bookkeeping , and get the AATQB letters after your name, sooner rather than later, on the way through to your full Level 3. This will allow you to update your CV to reflect your achievement sooner, making you more marketable and allowing you to reissue it to prospective employers.

So – in answer to my initial question “When to study Indirect Tax – before, after or in the middle of the other Level 3 units?” I am afraid that I may have disappointed you in not giving a simple answer of “Before”, “In the middle” or “At the end”. However, life is not simple and the answer will depend on your personal circumstances and your response to the factors raised above.

As standard, we will probably now schedule IDRX as the last unit (i.e. after the synoptic), to allow you to study it whilst awaiting the results of your synoptic. However, please let us know if you would prefer to study it in a different order. If you have a personal tutor, please do discuss the options with them.

For example: I recently planned Costing as the first unit for a student in accounting practice. Definitely not the normal order. However, as she has primarily been involved in payroll since she joined, she had limited experience in bookkeeping and certainly had no experience of accounts preparation and any month end adjustments. As it was planned to get her started on accounts prep later in the Spring, we felt that it would be more helpful for her to delay her bookkeeping units until she had started this work experience. Her studies would therefore be aligned to her work experience and each would help the other. The Costing unit was going to be pretty theoretical whenever she did it, so it seemed a good idea to do this at the start. We will do the IDRX unit after the two bookkeeping units, not after the synoptic, because she is an apprentice, and we don’t want to have to sit any exams after the End Point Assessment (which includes the synoptic).