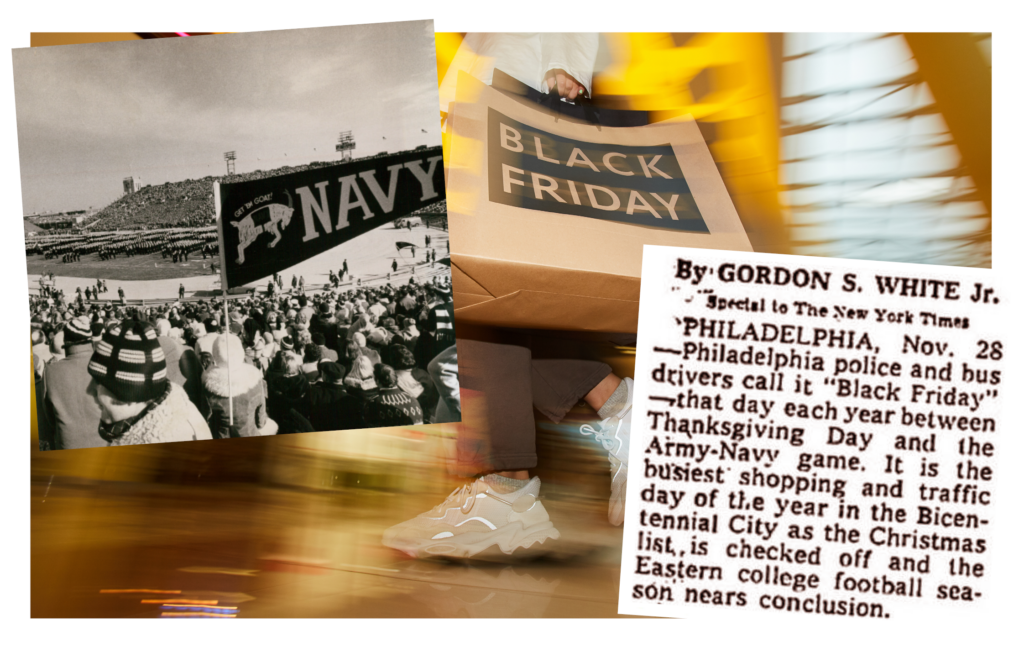

Every year, Black Friday arrives with the subtlety of a bull in a china shop, kick-starting the holiday shopping frenzy with deals so enticing they could coax even the most reluctant spender into a shopping spree. Originating in the 1960s in Philadelphia, the term “Black Friday” initially referred to the heavy traffic and chaos that ensued post-Thanksgiving, as shoppers made a mad dash for sales. Over the years, it has evolved to signify the moment when retailers’ profits move from “in the red” (losses) to “in the black” (profits). Nowadays, Black Friday is not just a U.S. phenomenon but a global shopping extravaganza with far-reaching implications for consumers and businesses alike. This blog takes a closer look at spending patterns during Black Friday, its impact on company accounts, and how businesses can effectively manage this high-stakes shopping event.

Global Spending on Black Friday

Black Friday has become a global event, influencing spending habits in countries far beyond the United States. In 2023, U.S. consumers led the charge, shelling out an impressive £29.3 billion. This staggering figure highlights Black Friday’s massive impact on American retail, setting the tone for the holiday shopping season.

In the UK, Black Friday fever has well and truly caught on, with consumers spending around £9.42 billion during the week in 2023. This growth is part of a broader European trend, where countries like Germany also see significant participation, with spending estimated at £3.2 billion.

Other countries, however, show varying levels of enthusiasm for Black Friday. Canada, being geographically and culturally close to the U.S., enjoys robust spending. On the other hand, countries like India, Japan, Australia, South Africa, and New Zealand show lower levels of spending. While Black Friday is gaining traction in India, it has yet to match the spending levels of more established markets. It seems the rest of the world is yet to discover the joys (and headaches) of this grand shopping spectacle.

Impact on Company Accounts

For businesses, Black Friday is a critical period that offers both opportunities and challenges. The surge in sales can have profound effects on company accounts, and navigating this period requires some nimble footwork:

- Revenue Recognition: Accountants have the unenviable task of accurately recording the revenue from Black Friday sales. For companies using accrual accounting, this means recognising revenue when the sale occurs rather than when payment is received. It’s all about ensuring that financial statements accurately reflect the true financial impact of Black Friday.

- Inventory Management: The high demand during Black Friday necessitates meticulous inventory management. Businesses must prepare for increased stock levels and manage post-event inventory effectively. Unsold stock may require further markdowns, impacting profit margins. Accountants need to track these adjustments to accurately reflect the cost of goods sold (COGS) and inventory levels. It’s a bit like playing Tetris, but with more at stake than just losing your high score.

- Cash Flow Management: The influx of sales can strain cash flow, especially with potential delays in payment processing and increased returns. Effective cash flow management strategies are crucial to ensure that businesses can meet their financial obligations. Accountants play a key role in forecasting and managing these cash flow dynamics, essentially acting as financial tightrope walkers.

- Marketing Costs: Significant expenditure on marketing and advertising is common during Black Friday. Accountants must accurately account for these costs to evaluate the return on investment (ROI) and overall profitability. Matching marketing expenses with corresponding revenue is essential for a true financial assessment. After all, you wouldn’t want to spend the entire marketing budget on inflatable wacky arm flailing tube men, only to find out they’re not bringing in the sales.

Brands That Excel in Black Friday Management

Several brands have mastered the art of Black Friday, using it as a springboard to enhance their market presence and drive sales:

- Amazon: Amazon takes a marathon approach, stretching Black Friday into a week-long event with pre-Black Friday deals. Their savvy use of data analytics to personalise offers and strong logistics capabilities help them maximize sales and manage inventory with ease. It’s like watching a well-oiled machine in action, but with more books and gadgets.

- Apple: Apple is the master of subtlety in the discount department, offering gift cards with purchases instead of steep price cuts. This strategy encourages future spending, enhancing customer loyalty and driving additional sales. Who knew that loyalty could be bought with a shiny new gadget and a gift card?

- John Lewis UK: John Lewis relies on its reputation for quality and customer service to draw in Black Friday shoppers. Their substantial discounts and effective marketing contribute to their success, proving that a little bit of British charm can go a long way.

Comparing Black Friday to Other Promotional Periods

When comparing Black Friday to other shopping events, it’s clear that Black Friday stands out in terms of spending, though it is not the only major retail event:

- Cyber Monday: Hot on the heels of Black Friday, Cyber Monday saw around £9 billion in spending in 2023. While substantial, Cyber Monday typically generates less revenue than Black Friday, though it remains a significant event for online sales.

- Holiday Season: Total holiday spending in the U.S. can exceed £805 billion, with Black Friday and Cyber Monday contributing significantly. This period remains the peak of consumer spending, akin to the retail version of the Olympics.

- Singles’ Day (China): Singles’ Day, held on November 11, dwarfs Black Friday in terms of sales, with Alibaba reporting over £67 billion in 2023. It’s like Black Friday on steroids, highlighting the massive scale of global retail events.

- Prime Day (Amazon): Amazon’s Prime Day, held in July, generated around £10.2 billion in sales in 2023. While significant, it generally pales in comparison to Black Friday in terms of overall consumer spending.

Christmas and Other Seasonal Periods: Christmas season spending in many countries can reach around £80-100 billion, with Black Friday contributing a notable but smaller portion. Easter and back-to-school periods also see increased spending, but not on the same scale as Black Friday. They’re more like the warm-up act for the main event.

Conclusion

Black Friday has a profound impact on retail spending and company accounts, driving significant revenue while presenting challenges in inventory management, cash flow, and marketing costs. Successful brands have honed their strategies to navigate these challenges effectively, leveraging data, omnichannel retailing, and strategic marketing.

By understanding these dynamics, businesses can better prepare for Black Friday and optimise their financial performance, ensuring they capitalize on this crucial shopping event while maintaining robust financial management.

For more support and resources for your AAT journey, visit Accountancy Learning. To explore more about the AAT and how it can help you achieve your career goals, check out AAT.

For any other questions, please get in touch with us, as we are always happy to help. Call us at 01392 435349 or email us at [email protected].

The view from AL Marketing

Black Friday has evolved significantly over the years, transitioning from a single day of sales into a long, drawn-out sales period that often starts weeks before November ends and merges into Christmas promotions. While this elongated sales season can help consumers plan their spending in advance—particularly in the run-up to Christmas—it can also blur the lines of what is a genuine deal.

On the positive side, spreading sales over a longer period allows people to shop more thoughtfully, avoiding the old frustration of buying a gift in November only to see it discounted further in January. However, it also raises questions about transparency. Reports of price manipulation—where prices are inflated before being ‘discounted’—and the re-advertising of old stock as part of the sale are concerning.

In its current form, I don’t see Black Friday as a sale designed to truly benefit the consumer. Instead, it often feels more like a strategy to support the retailer’s balance sheet and keep accountants happy. While that’s an understandable goal from a business perspective, it does make it harder for consumers to trust whether they’re getting a good deal or simply being drawn in by clever marketing.

Ultimately, Black Friday’s focus seems to be more on the retailer than the consumer. Greater transparency and fair pricing practices could help strike a better balance, ensuring it’s a win for everyone involved.