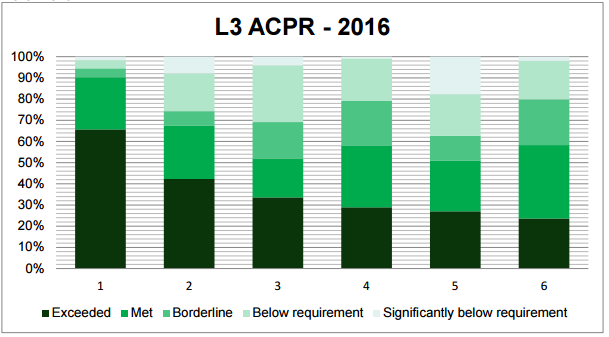

Whilst marking various progress tests and practice assessments, I find there are certain areas that regularly cause students problems. In the AAT Level 3 Advanced Diploma (and within Accounts Preparation / Advanced Bookkeeping), one of the problem areas tends to be Accruals and Prepayments (yes I saw you shudder and pull a face!) Below are the latest results from the related AAT exam (Task 3 is Accruals and Prepayments):

When I was studying my AAT Level 3, I was taught the clever trick – Accruals has a cr in it – this works well with expenses, as accrued expenses build up on the credit side. Then I reverse it for income, if this is what the question is looking for. I also reverse it for prepayments of expenses. Originally, this was enough to get me started and then I established the logic behind it i.e. I started to understand why I was debiting and crediting the various accounts.

When looking to see if I could find any clever tips for remembering these dreaded concepts, I came across shops – Dorothy Perkins (Debit Prepayments), C&A (Credit Accruals). This is helpful, although it may be worth trying to remember other items – find your interest and try and link it in – this works for me as I love to shop!

As an exam tip I would suggest that you write DEAD CLIC at the top of your page and keep referring back to it; making little notes like this can help, and it never hurts to go back to the basics.

New to AAT qualifications? Before we get started, you might find it useful to know what the AAT Advanced Diploma includes – you can read more about it HERE:

Accrued Expense:

This is effectively a liability because the business owes it. Therefore, it must build up on the CR side of the Accrued Expenses account (until it has been paid).

Accrued Income:

This is income that the business has earned but for which it has not yet raised a sales invoice or been paid (if it had, it would have been included in debtors or cash (Dr Debtors; Cr Sales or Dr Cash; Cr Sales). This is therefore an asset i.e. money that is owed to the business; therefore it builds up on the DR side of the Accrued Income account.

Prepayment of an Expense:

This is also effectively an asset, because the business has paid for something it has not yet received. Therefore, it must build up on the DR side of the Prepaid Expenses account.

Prepaid Income:

This is effectively a liability, because the business has not yet earned the value of the invoice that it sent out. For example: you receive a payment for rent in January, which relates to January, February and March. However, we haven’t reached February and March yet, therefore it must build up on the CR side of the Prepaid Income account.

Example 1:

Let’s go with an example and put this practice into place. You have been given the following information:

Sundry Income: there was an opening accrued balance of £550 on 1/1/2016 in the Sundry Income account. There have been receipts during 2016 of £6,300. These include £350 that relate to the first month of the following year.

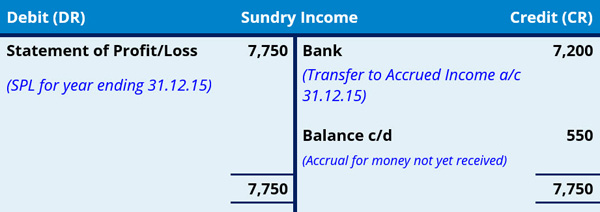

a) SUNDRY INCOME:

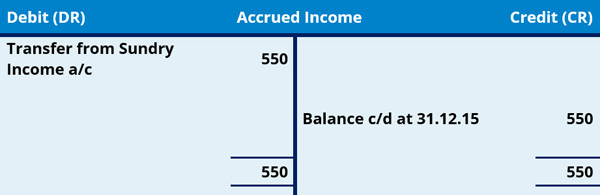

Let’s start with what happened at the end of last year:

You had not yet raised an invoice for the Sundry Income of £350, therefore you needed to ‘Accrue’ for this by adjusting the Income (CR) side of the Sundry Income account. This provides us with the actual income for the year (in accounting terms) of £7,750:

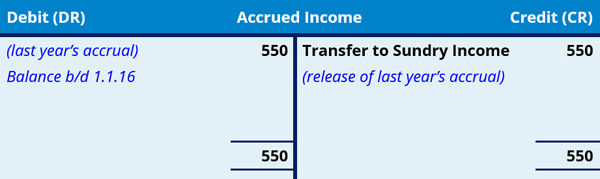

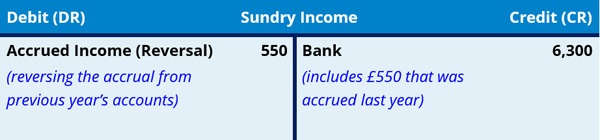

At the start of the current year, you raise and are paid for this outstanding amount. Therefore, the bank receipts figure for 2016 of £6,300 includes £550 that relates to income earned last year (i.e. 2015). We therefore need to remove it from income in the 2016 accounts. This is done by transferring the balance on the accrued income account back to the Sundry Income Account. See below:

At the moment, the Accrued Income account has a Nil balance and the Sundry Income account has a balance of £5,750 (being the bank receipts of £6,300 less the receipts of £550 that relate to last year’s earned income.

Now let’s carry on with the rest of the year’s transactions:

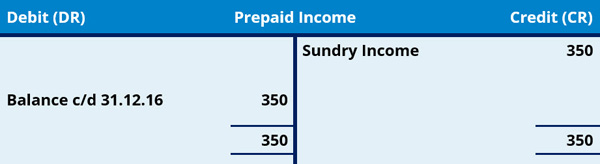

We have been told that the balance brought down as at 1.1.2016 is £550 (accrued), and that the balance carried down at 31.12.16 is £350 (prepaid) – these would both be entered on the Debit side of the Sundry Income account as above.

A prepayment is money which the business has received but not yet earned, so it also reduces the figure that will be entered on the Statement of Profit/Loss (because it doesn’t relate to this year’s accounts). We therefore need to transfer this prepayment to the Prepaid Income Account and then calculate the balancing figure for the Sundry Income Account. This is £5,400 on the Debit side and so the other side of the double entry will be a Credit in the Statement of Profit/Loss (i.e. Income).

I hope this has helped – look out for Accruals and Prepayments Part 2 next week.

In the meantime, happy studying!

P.S. Did you know that you can now apply for AAT Licensed Bookkeeper* status – it means that you can put AATQB after your name. Find out more about it HERE:

(*You will need to have achieved the AAT Advanced Certificate in Bookkeeping or the AAT Advanced Diploma in Accounting)

We hope that these study tips have helped you! Whilst we are not able to respond to any specific questions you might have about our posts, do please let us know if there are any further topics you would like us to write about. If, however, you are one of our tutor-supported students, please get in touch with your personal tutor who will be more than happy to help you.