Deciding whether or not to capitalise expenditure can be tricky…

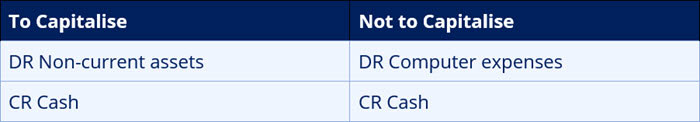

Almost two decades ago a telecom giant in the USA, Worldcom, fraudulently capitalised computer paraphernalia such as cables and memory sticks. Compare the two double entries:

What was the effect of Worldcom’s approach? They didn’t debit an expense and were able to overstate their profit. It was fraud because it went against their capitalisation policy and they did it to misrepresent their financial performance. Their external auditors did not spot this. Their internal auditors dealt with it but only after receiving whistle blowing disclosure.

The issue of capitalisation affects auditors as we have seen but also financial accountants and tax practitioners. So multiple AAT units are affected by this. The financial reporting is further complicated by the differing treatment in UK GAAP compared with IFRS.

Initial recognition

Revenue expenditure is expenditure relating to the trade of the business and if related to non-current assets, must be expenditure for the repair or maintenance of the asset. Capital expenditure is for the acquisition or construction of a non-current asset.

Based on this, Worldcom did nothing wrong. Computer cables are often used for more than one year and meet the definition of non-current assets. But it is normal for businesses to apply a materiality threshold. Items will normally only be capitalised if their value is over a certain value. Small items are expensed. Worldcom had such a de minimis limit but purposely ignored it to improve reported profit.

The auditors should have spotted this because a typical audit procedure is to inspect purchase documentation such as invoices and assess if they are of a capital nature or not. Worldcom’s auditors should have identified that items which should not have been capitalised according to their company policy were being capitalised.

Subsequent expenditure

The IFRS and UK GAAP treatment used to be the same but when IAS 16 Property, plant and equipment was revised in 2003 the treatment changed. FRS 102 and UK tax treatment are the same for subsequent expenditure.

Under FRS 102 and UK tax rules, if expenditure maintains the life of a non-current asset or maintains its earning capacity then it is revenue expenditure. If the expenditure “provides incremental future benefits” (FRS 102 paragraph 17.6), that is, it improves the earning capacity or extends the life of the non-current asset then it is capital expenditure. This may require some judgement. Suppose we replace the seats in an aeroplane because they have become dirty and shabby. Replacing the old seats does not lengthen the life of the aeroplane. Would the new seats improve the earning capacity? Would customers who had become fed up with the old dirty seats and who had thought twice about booking with that airline reconsider now that there were nice, new seats installed? The new seats are lighter allowing the aeroplane to use less fuel. Does that make a difference? Depending on how you argue the case it is not straightforward to decide whether to capitalise or not to capitalise.

If we do capitalise the replacement parts then the old parts should be derecognised. That makes sense. We are not using them any more and if we genuinely physically dispose of the seats then we should in the accounts too. FRS 102 tells us that if the replaced parts did not have a book value of their own, that is, they were not depreciated separately to the main asset then we should estimate its disposal book value by taking the replacement cost and applying depreciation to it for the period it has been used (paragraph 17.6).

IAS 16 Property, plant and equipment takes a different approach. Maintenance and the day-to-day servicing of an asset is still a revenue expense. IAS 16 suggests that this includes labour, consumables and small parts (paragraph 12). But any addition to a non-current asset is capitalised (paragraph 13). These additions do not need to show an incremental future benefit. The new seats in the aeroplane are capitalised. Repainting the aeroplane is capitalised. Any addition is capitalised even if there is no incremental benefit. There is no more judgement. The risk of fraud is reduced.

IAS 16 also tells us that if we capitalise the new seats then we also dispose of the old seats (paragraph 13) just like FRS 102. If the disposed component does not have a net book value of its own then we value the old component as the same as the cost of the replacement (paragraph 70). We do not depreciate it as we do in FRS 102.

Let’s compare the two approaches side-by-side. We’ll assume that the seats are not considered an improvement using FRS 102.

We can see that the overall effect is the same. Both show an expense of £15,000.

Now, let’s assume that the seats are considered an improvement using FRS 102 but the seats have not been separately depreciated so we’ll need to estimate their value for the disposal.

Under FRS 102, the value of the seats on disposal have been adjusted for assumed depreciation while they have been used, but under IAS 16 they have not been depreciated and the replacement cost has been used as the carrying value of the seats on disposal.

Businesses with the resources to do so will split up an asset into components and depreciate each according to the useful lives of each component. The aeroplane’s fuselage may be depreciated over 20 years, the seats over 10 years and so on. There may be a cost of administering this extra level of detail but it may result in lower disposal costs and less fluctuations in profit when we replace components of assets.

From a tax point of view, any remaining written down value of a disposed asset would be tax deductible. So while the tax and IAS 16 treatments are different, the long term effect is the same.

This can be a difficult area to study because you may be applying FRS 102 at work but studying IAS 16 in your AAT studies and tax rules in your business tax exam. If you work for a subsidiary of an American company you might have to apply US GAAP too. But let’s not go there now. People can get confused because of the different rules and the lack of consistency from one exam to the other. So it’s important that you study each unit carefully and not assume that the treatment in one exam is the same as another or the same as what you may do at work.